Condensed Interim Financial Statements For the six months ended 30 September 2024

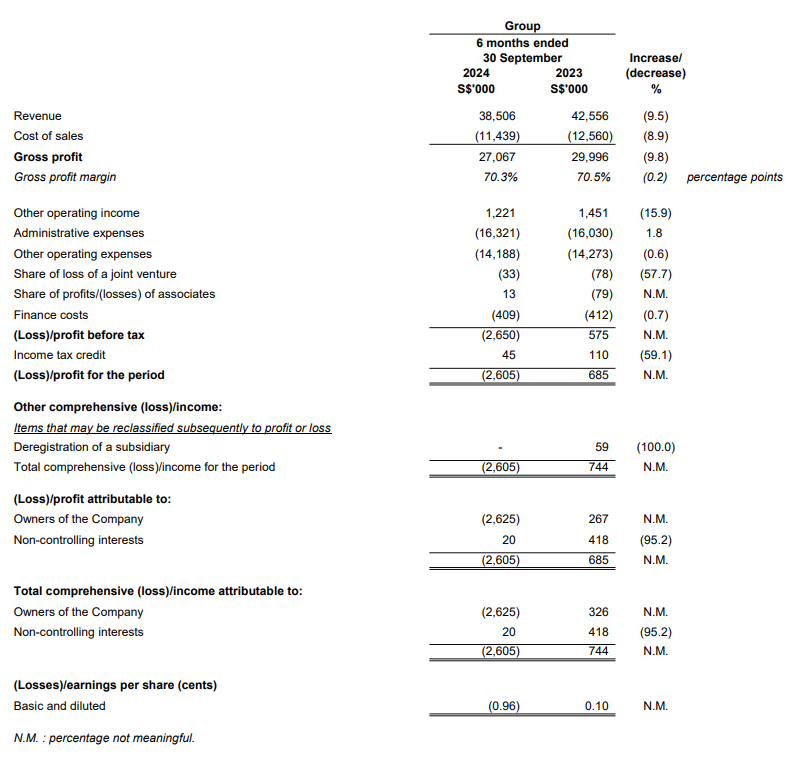

Condensed Interim Consolidated Income Statement And Statement Of Comprehensive Income For the Financial Period ended 30 September 2024

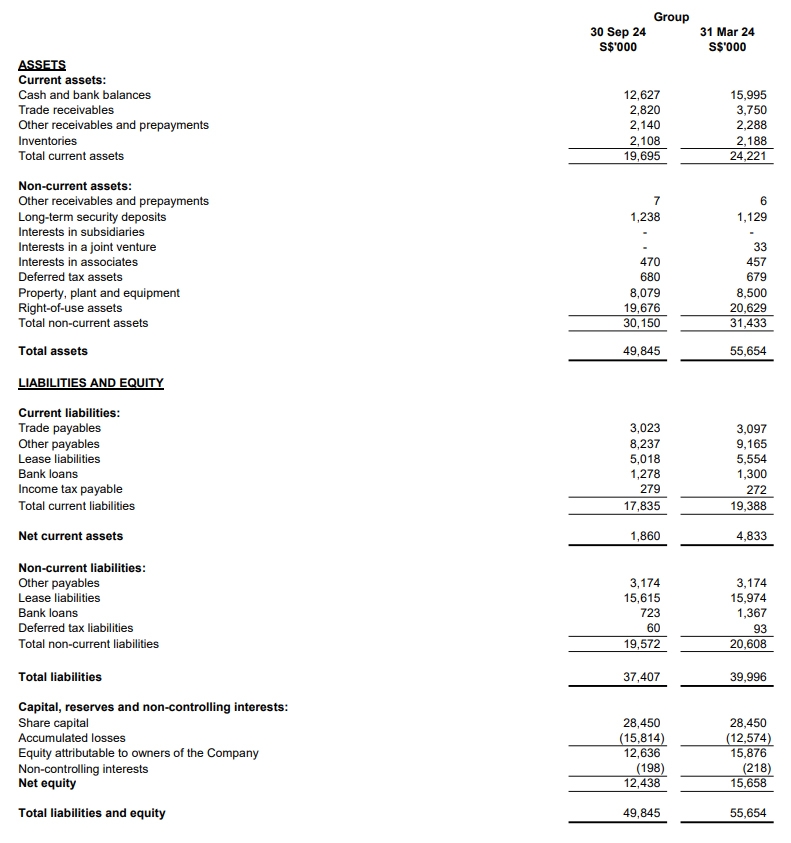

Condensed Interim Statements Of Financial Position

Review of the performance

Revenue

The Group's revenue for the six months ended 30 September 2024 ("HY25") decreased by S$4.1 million (9.5%) to S$38.5 million compared to S$42.6 million for the six months period ended 30 September 2023 ("HY24") mainly due to:

- S$2.0 million loss of revenue contribution from 3 outlets which were closed during the financial year ended 31 March 2024("FY24");

- S$1.5 million lower revenue contribution from the catering business; and

- S$0.6 million lower revenue contribution from existing outlets.

Gross profit margin

Gross profit decreased by S$2.9 million (9.8%) to S$27.1 million in HY25 from S$30.0 million in HY24, in line with the lower revenue. Gross profit margin decreased by 0.2 percentage points to 70.3% in HY25 from 70.5% in HY24 due to higher food raw material costs.

Other operating income

Other operating income decreased by S$0.2 million (15.9%) to S$1.2 million in HY25 from S$1.4 million in HY24 mainly due to:

- S$0.1 million lower catering service income;

- S$0.1 million lower interest income earned and markerting promotion funds received; and

- absence of S$0.1 million reversal of provision for reinstatement cost for an outlet which was closed during FY24.

This is partially offset by S$0.1 million dividend received from an unquoted equity in HY25.

Administrative expenses

Administrative expenses, mainly manpower-related expenses, increased by S$0.3 million (1.8%) to S$16.3 million in HY25 from S$16.0 million in HY24 due to salary adjustments in HY25 to improve staff retention.

Other operating expenses

Other operating expenses decreased by S$0.1 million (0.6%) to S$14.2 million in HY25 from S$14.3 million in HY24 mainly due to:

- S$0.2 million lower depreciation of property, plant and equipment; and

- absence of S$0.1 million loss arising from the deregistration of a subsidiary.

This is partially offset by S$0.2 million higher advertising and promotion expenses in HY25.

Share of loss of a joint venture

Share of loss of a joint venture decreased by S$45,000 (57.7%) to S$33,000 in HY25 from S$78,000 in HY24 due to cessation of business operation of the joint venture during HY25.

Share of profits/(losses) of associates

Share of profits of associates of S$13,000 in HY25 compared to share of losses of associates of S$79,000 in HY24 due to net profit contribution from associates in HY25 due to the absence of loss on disposal of investment in an unquoted equity recorded by an associate in HY24.

Income tax credit

Income tax credit decreased by S$65,000 (59.1%) to S$45,000 in HY25 from S$110,000 in HY24 mainly due to lower deferred tax benefits recorded in HY25.

(Loss)/profit attributable to the owners of Company

The Group recorded a loss attributable to the owners of the Company amounting to S$2.6 million in HY25 compared to a profit of S$0.3 million in HY24. This was mainly due to a decline in overall revenue in HY25 compared to HY24, driven by poor consumer sentiment amid uncertain economic outlook in HY25.

Tiong Woon is a leading one-stop integrated heavy lift specialist and service provider, supporting mainly the oil and gas, petrochemical, infrastructure and construction sectors, with proven track record of more than 45 years.

Tiong Woon is a leading one-stop integrated heavy lift specialist and service provider, supporting mainly the oil and gas, petrochemical, infrastructure and construction sectors, with proven track record of more than 45 years.

Cash and bank balances

Decrease in cash and bank balances at Group level was mainly due to:

- S$3.5 million repayment of lease obligations and interest;

- S$0.7 million repayment of bank borrowings;

- S$0.6 million dividend payment to shareholders of the Company; and

- S$0.6 million cash outlays for renovating and acquiring plant and equipment for existing outlets.

This is partially offset by S$1.9 million operational cash inflow.

Decrease in cash and bank balances at Company level was mainly due to dividend payment to shareholders of the Company.

Trade receivables

Decrease in trade receivables at Group level was mainly due to lower credit sales from catering events amid lower revenue generated from catering division.

Other receivables and prepayments (current)

Decrease in other receivables and prepayments (current) at Group level was mainly due to S$0.1 million lower government grant receivable following the disbursement of previously accrued grants and lower prepayment made for food materials amounting to S$0.1 million.

Inventories

Decrease in inventories at Group level was consequent to lower revenue generated in HY25.

Long-term security deposits

Increase in long-term security deposits at Group level was mainly due to the additional rental deposits for renewed leases.

Interests in a joint venture

Decrease in interests in a joint venture at Group level was mainly due to share of loss of joint venture amounting to S$33,000 in HY25.

Interests in associates

Increase in interests in associates at Group level was due to share of profits of associates amounting to S$13,000 in HY25.

Property, plant and equipment

Decrease in property, plant and equipment at Group level was mainly due to S$1.1 million depreciation charge but partially offset by acquisition of plant and equipment for existing outlets amounting to S$0.7 million during HY25.

Right-of-use assets

Decrease in right-of-use assets at Group level was mainly due to S$3.2 million depreciation charge but partially offset by addition of right-of-use assets amounting to S$2.3 million during HY25.

Other payables (current)

Decrease in other payables (current) at Group level was mainly due to S$0.5 million decrease in staff-related accrued expenses and decrease in deferred revenue of S$0.4 million.

Lease liabilities (current and non-current)

Decrease in lease liabilities at Group level was mainly due to S$3.2 million settlement of lease obligations but partially offset by S$2.3 million addition of lease liabilities during HY25.

Bank loans (current and non-current)

Decrease in bank loans at Group level was mainly due to loan repayments of S$0.7 million during HY25.

Total assets

Total assets of the Group decreased by S$5.9 million (10.6%) to S$49.8 million as at 30 September 2024 from S$55.7 million as at 31 March 2024 mainly due to:

- decrease in cash and bank balances of S$3.4 million

- decrease in trade, other receivables and prepayments of S$1.1 million;

- decrease in right-of-use assets of S$1.0 million;

- decrease in property, plant and equipment of S$0.4 million; and

- decrease in inventories of S$0.1 million.

This was partially offset by increase in long-term security deposits of S$0.1 million.

Total liabilities

Total liabilities of the Group decreased by S$2.6 million (6.5%) to S$37.4 million as at 30 September 2024 from S$40.0 million as at 31 March 2024 mainly due to:

- decrease in trade and other payables of S$1.0 million;

- decrease in lease liabilities of S$0.9 million; and

- decrease in bank borrowings of S$0.7 million.

Cashflow

The Group’s operational cashflow recorded a net inflow of S$1.9 million in HY25 compared to net inflow of S$2.8 million in HY24. The decrease was mainly due to lower revenue generated and settlement of manpower-related accrued expenses in HY25.

The Group’s investing cashflow recorded a net outflow of S$0.5 million in HY25 compared to S$1.6 million in HY24. The decrease was mainly due to reduced acquisition of plant and equipment for existing outlets in HY25.

The Group’s financing cashflow recorded a net outflow of S$4.8 million in HY25 compared to S$6.2 million in HY24. The decrease was mainly due to lower dividend payment to shareholders of the Company in HY25.

Overall, the Group’s cash position decreased by S$3.4 million to S$12.6 million in HY25 from S$16.0 million as at 31 March 2024.

Working capital

The Group's net working capital decreased by S$2.9 million to S$1.9 million as at 30 September 2024 from S$4.8 million as at 31 March 2024 due to operating loss recorded in HY25 and payment of S$0.6 million dividend to shareholders of the Company.

Commentary on current year prospects

The Group has reported a loss in HY25 due to the ongoing uncertain economic outlook affecting consumer sentiment and intensified competition from the entry of new competitors in food and beverage ("F&B") industry in Singapore. While the Group anticipates the operating environment for F&B industry to remain challenging, it remains cautiously optimistic, as its performance in the first half of the financial year (April to September) is traditionally weaker compared to the second half (October to March).

In response to these economic headwinds, the Group is actively refining its menu offerings to remain competitive, while implementing digital initiatives aimed at enhancing dining experience and improving operational efficiencies.

Through these efforts, the Group is confident it will be able to weather the challenging operating environment and to position itself for future growth.