TUNG LOK RESTAURANTS (2000) LTD / Annual Report

2016

83

Notes to the financial statements

For the financial year ended 31 March 2016

25.

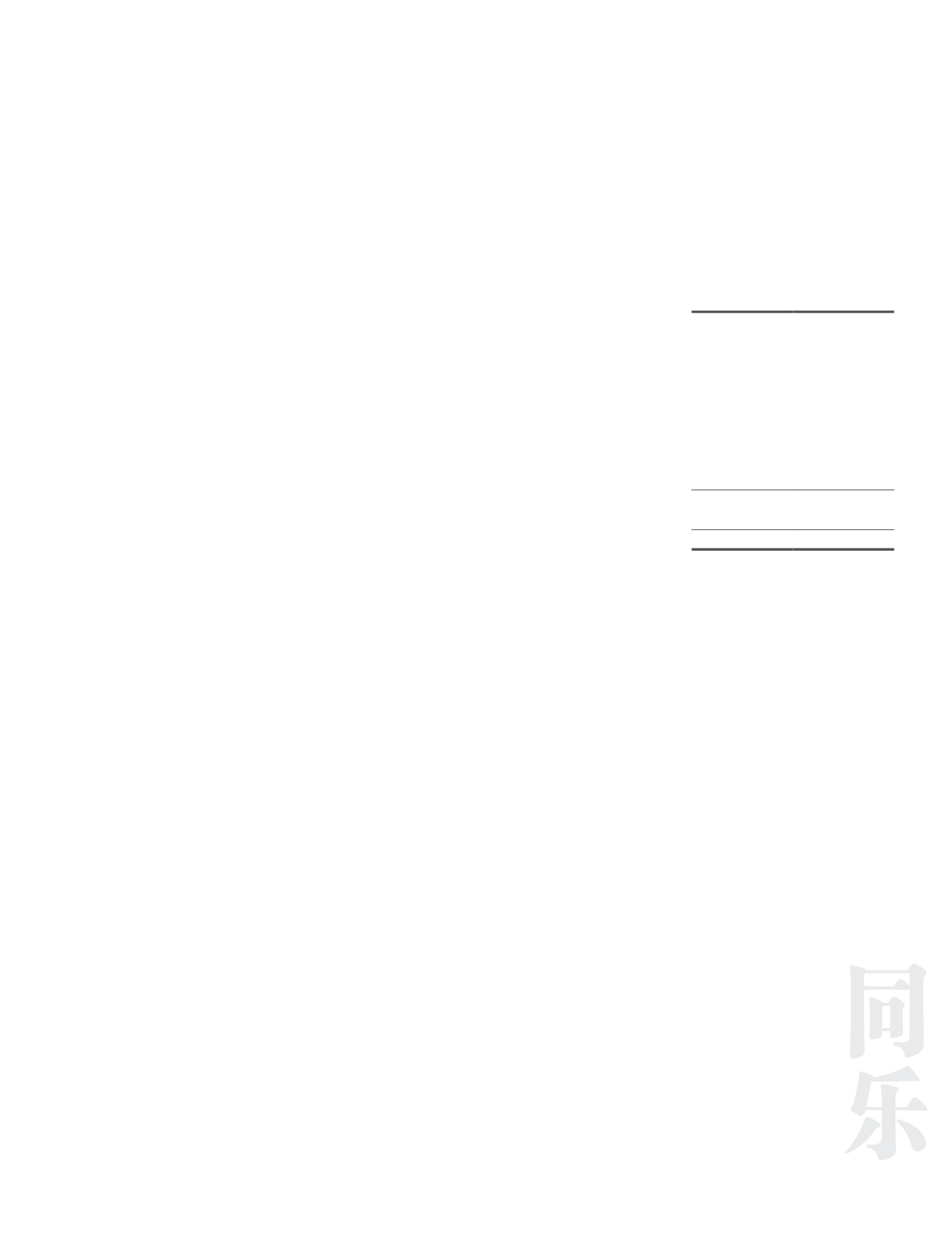

Bank loans

Group

2016

2015

$

$

Long-term bank loans

3,276,230 5,249,376

The borrowings are repayable as follows:

On demand or within one year

538,056 2,018,496

In the second year

562,524

544,377

In the third year

348,615

557,397

In the fourth year

194,640

338,516

In the fifth year

199,544

187,917

After five years

1,432,851 1,602,673

3,276,230 5,249,376

Less: Amount due for settlement within 12 months (shown under current liabilities)

(538,056)

(2,018,496)

Amount due for settlement after 12 months

2,738,174 3,230,880

The Group has the following principal bank loans:

(a)

a loan of $1,750,089 (2015: $$1,839,432). The loan was raised in August 2013. Repayment commenced in

September 2013 and will continue until August 2028. The loan carries effective interest rate at 2.63% (2015:

1.98%) per annum, which is swap offer rate plus 1.5%;

(b)

a loan of $900,572 (2015: $1,253,602). The loan was raised in July 2013. Repayment commenced in September

2013 and will continue until August 2018. The loan carries effective interest rate at 3.01% (2015: 2.47%) per

annum, which is swap offer rate plus 2.0%;

(c)

a loan of $476,322 (2015: $497,549). The loan was raised in December 2010. Repayment commenced in January

2011 and will continue until December 2030. The loan carries effective interest rate at 2.63% (2015: 1.95%) per

annum, which is swap offer rate plus 1.5%;

(d)

a loan of $149,247 (2015: $172,245). The loan was raised in July 2001. Repayment commenced in August 2001

and will continue until February 2021. The loan carries effective interest rate at 2.63% (2015: 1.97%) per annum,

which is swap offer rate plus 1.5%;

(e)

a loan of $Nil (2015: $917,500). The loan was raised in March 2012. Repayments commenced in March 2013 and

ended in March 2016. The loan carries effective interest at 2.61% (2015: 2.09%) per annum, which is cost of fund

plus 1.6%; and

(f)

several other smaller loans ranging from $58,000 to $160,000 in the previous financial year which have been fully

repaid during the current financial year. These loans carry effective interest rate ranging from 2.8% to 3.0%.

The bank loans are secured by way of:

(i)

a charge over the leasehold property of a subsidiary as disclosed in Note 20 to the financial statements; and

(ii)

a corporate guarantee issued by the Company.

Management estimates the fair value of the above loans to approximate their carrying amounts.