TUNG LOK RESTAURANTS (2000) LTD / Annual Report

2016

91

Notes to the financial statements

For the financial year ended 31 March 2016

33.

Financial risks management objectives and policies (cont’d)

(d)

Liquidity risk management (cont’d)

Liquidity and interest risk analyses

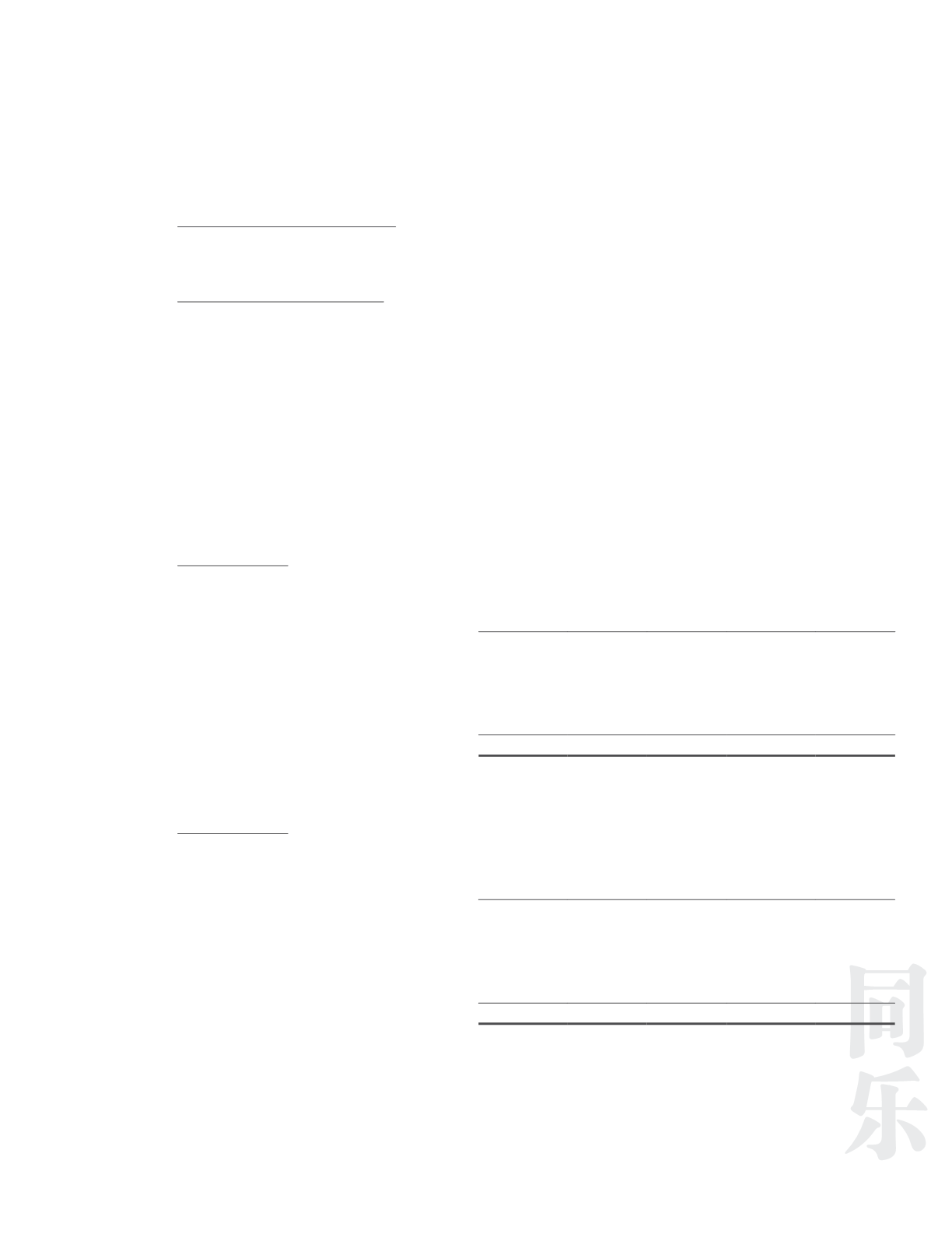

Non-derivative financial liabilities

The following table details the remaining contractual maturity for non-derivative financial liabilities. The table has

been drawn up based on the undiscounted cash flows of financial liabilities based on the earliest date on which

the Group and the Company can be required to pay. The table includes both interest and principal cash flows.

The adjustment column represents the possible cash flows attributable to the instrument included in the maturity

analysis which is not included in the carrying amount of the financial liabilities on the statement of financial

position.

Group

2016

Weighted

average

effective

interest rate

On demand

or within

1 year

Within 2 to

5 years

After

5 years Adjustment

Total

%

$

$

$

$

$

On balance sheet

Non-interest bearing:

Trade payables

–

3,362,408

–

–

– 3,362,408

Other payables

3.37

7,556,943 2,890,030

– (255,469) 10,191,504

10,919,351 2,890,030

– (255,469) 13,553,912

Finance leases (fixed rate)

2.77

241,541 490,481

–

(85,911)

646,111

Variable interest rate instruments:

Bank loans

2.73

626,111 1,499,855 1,575,567 (425,303) 3,276,230

Total

11,787,003 4,880,366 1,575,567 (766,683) 17,476,253

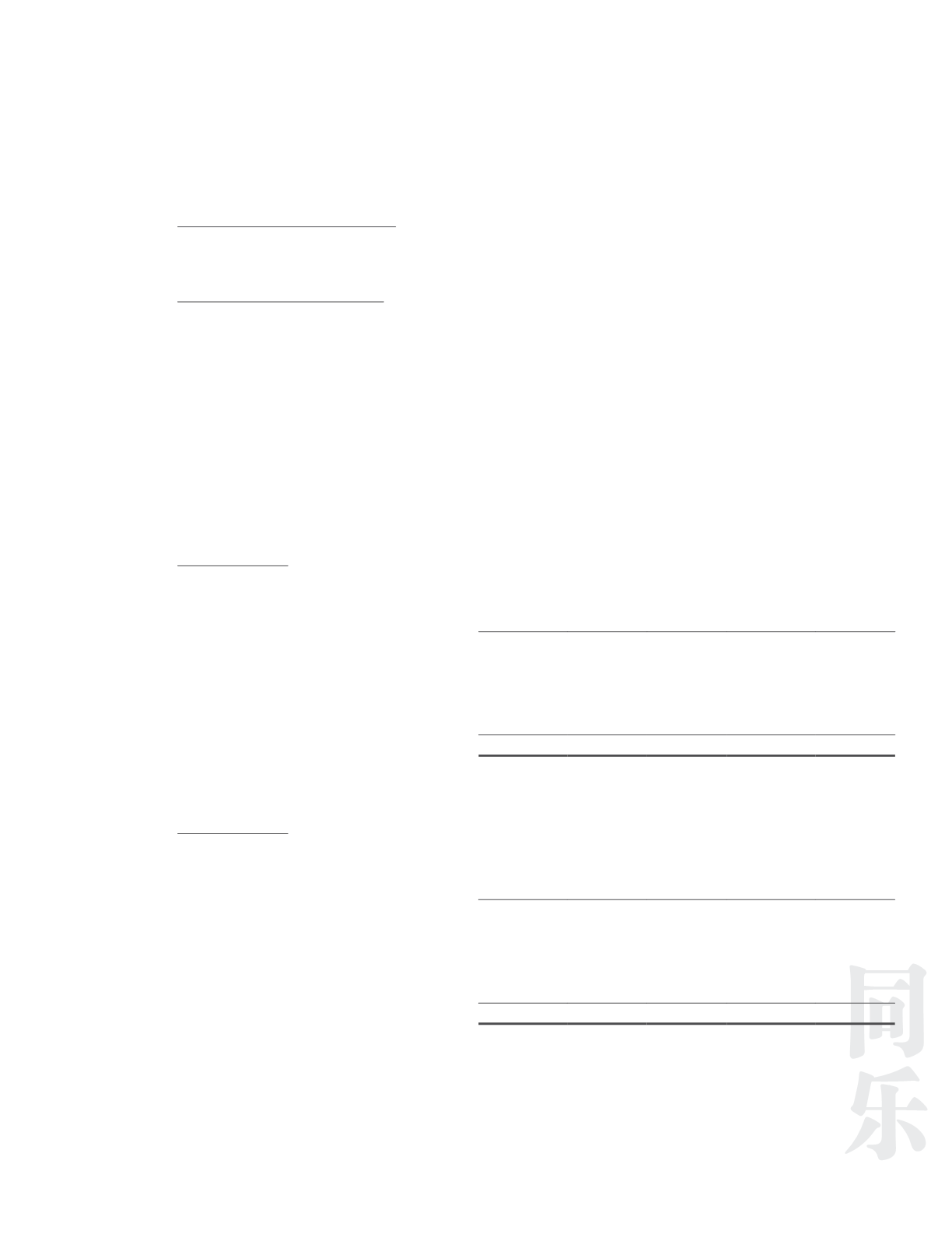

2015

On balance sheet

Non-interest bearing:

Trade payables

–

3,660,296

–

–

– 3,660,296

Other payables

6.00

8,442,152 2,928,880

–

(94,958) 11,276,074

12,102,448 2,928,880

–

(94,958) 14,936,370

Finance leases (fixed rate)

2.72

192,684 459,641

–

(72,523)

579,802

Variable interest rate instruments:

Bank loans

2.20

2,123,180 1,825,158 1,756,715 (455,677) 5,249,376

Total

14,418,312 5,213,679 1,756,715 (623,158) 20,765,548