TUNG LOK RESTAURANTS (2000) LTD / Annual Report

2016

94

Notes to the financial statements

For the financial year ended 31 March 2016

33.

Financial risks management objectives and policies (cont’d)

(d)

Liquidity risk management (cont’d)

Non-derivative financial assets (cont’d)

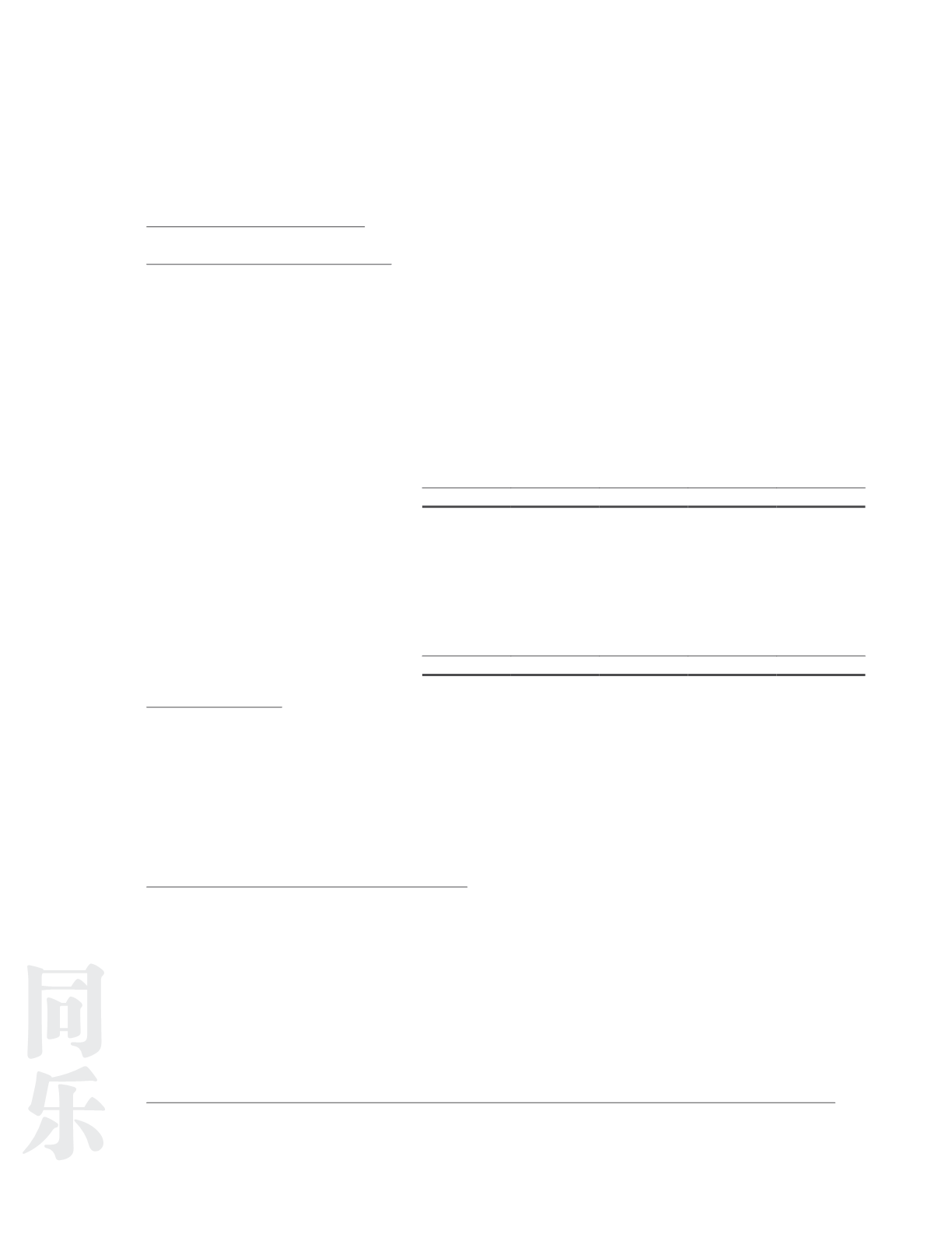

Company

2016

Weighted

average

effective

interest rate

On demand

or within

1 year

Within 2 to

5 years

After

5 years Adjustment

Total

%

$

$

$

$

$

Non-interest bearing:

Cash and bank balances

–

3,321,030

–

–

– 3,321,030

Other receivables

–

72,083

–

–

–

72,083

Advances to subsidiaries

(Note 16(A))

2.91

– 9,994,480

– (909,867)

9,084,613

Total

3,393,113 9,994,480

– (909,867) 12,477,726

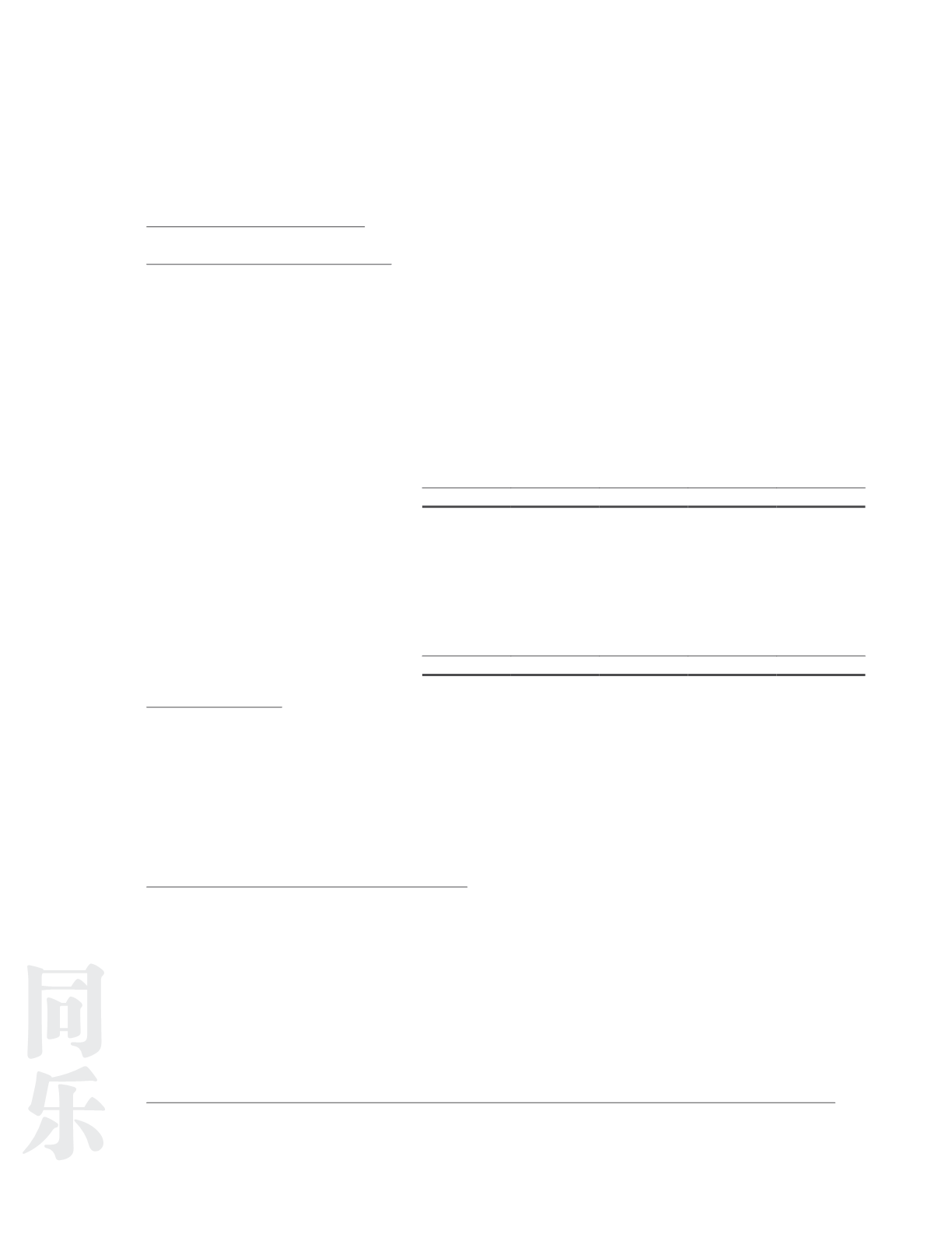

2015

Non-interest bearing:

Cash and bank balances

–

6,315,325

–

–

– 6,315,325

Other receivables

–

729,821

–

–

–

729,821

Advances to subsidiaries

(Note 16(A))

3.16

– 5,977,871

– (226,695)

5,751,176

Total

7,045,146 5,977,871

– (226,695) 12,796,322

(e)

Commodity price risk

Certain commodities, principally shark’s fins, dried foodstuff, meat, fish and other seafood delicacies, are

generally purchased based on market prices established with the suppliers. Although many of the products

purchased are subject to changes in commodity prices, certain purchasing contracts or pricing arrangements

contain risk management techniques designed to minimise price volatility. Typically, the Group uses these

types of purchasing techniques to control costs as an alternative to directly using financial instruments to

hedge commodity prices. Where commodity cost increases significantly and appears to be long-term in nature,

management addresses the risk by adjusting the menu pricing or changing the product delivery strategy.

(f)

Fair value of financial assets and financial liabilities

The carrying amounts of cash and bank balances, trade and other current receivables, trade and other payables

approximate their respective fair values due to the relatively short-term maturity of these financial instruments.

The fair values of other classes of financial assets and liabilities are disclosed in the respective notes to financial

statements.

The fair values of financial assets and financial liabilities are determined in accordance with generally

accepted pricing models based on discounted cash flow analysis using prices from observable current market

transactions.

(g)

Financial instruments subject to off-setting, enforceable master netting arrangements and similar agreements

The Group does not have any financial instruments which are subject to offsetting under enforceable master

netting arrangements or similar netting agreements.